- Home

- News & Analysis

- Forex

- A Pivotal Moment For Sterling

A Pivotal Moment For Sterling

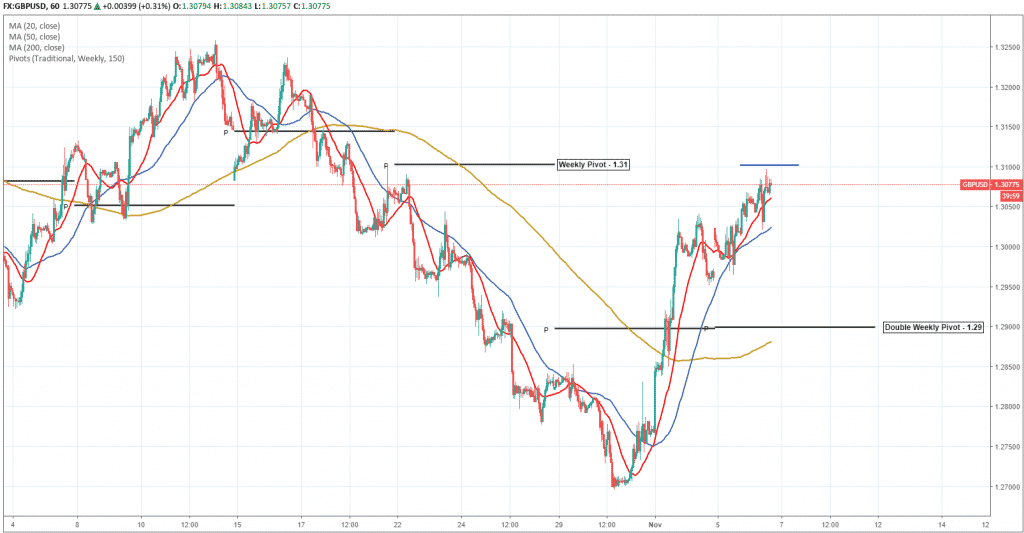

November 6, 2018GBPUSD – Has Cable run out of steam?

Looking at GBPUSD, we can see the month of November has kicked off with some impulsive moves higher off the back of potential Brexit deals concluding behind closed doors.

In the short-term, we might be witnessing the tail end of the recent rally as price action is showing signs of exhaustion, particularly as it reaches the previous weekly pivot region of 1.31. We can clearly see some resistance emerging here. Another element to remember is that the trend remains firmly bearish on the daily timeframe, so hints of selling pressure creeping in is perhaps to be expected.

If sellers do regain some control, the chart above suggests a key target for the pair would be the double weekly pivot area of 1.29. Generally speaking, whenever we see these type of pivots, price tends to gravitate towards them as market participants seek a middle ground.

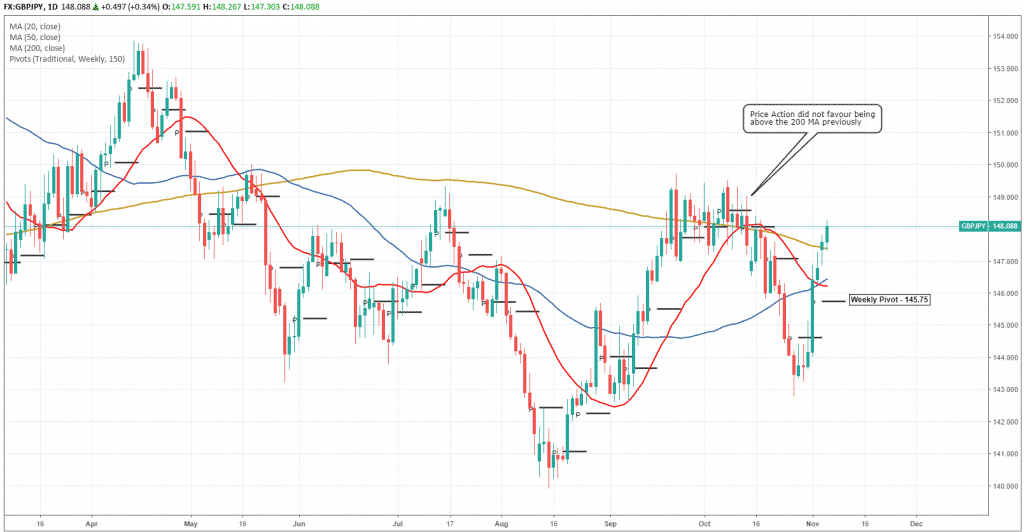

GBPJPY – Looking Shaky Above The 200 Day MA

Switching to GBPJPY, we are technically in bullish territory thanks to yesterday’s close above the 200 Day Moving Average (Gold Line). Considering how price reacted last time above these levels, it might be temporary unless we see further positive reports released for Sterling in the coming days.

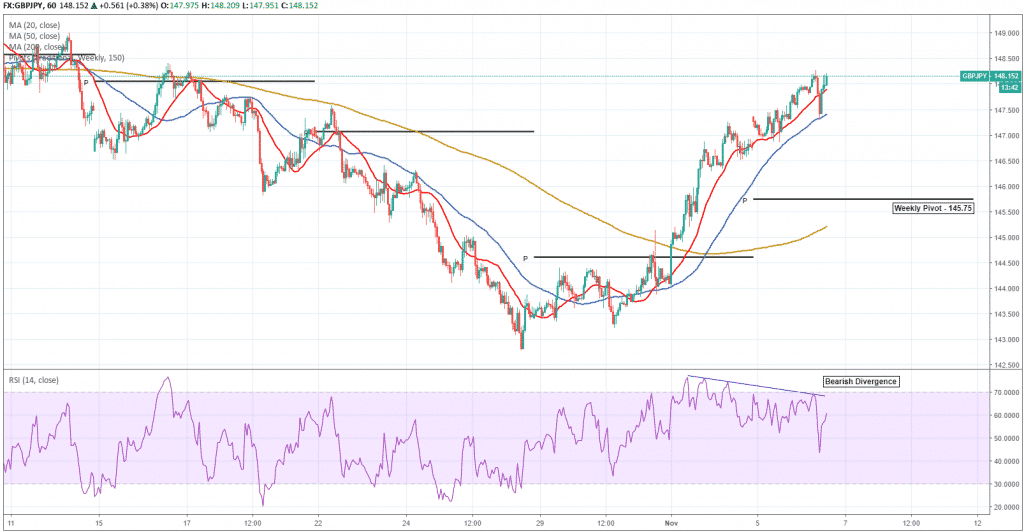

Similar to GBPUSD, I see a potential drop on the horizon for the pair, targeting another weekly pivot. On the hourly chart below, we see evidence of some bearish divergence developing on the RSI (Relative Srength Index), coupled with price teetering around overbought levels. It may well become the fuel that sparks a shift towards the weekly pivot of 145.75.

If you would like to see more pivot point action, take a look at our Chart Of The Day on the daily report by Klavs Valters.

By Adam Taylor

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk. For more information on trading Forex, check out our regular free Forex webinars.

Sources: TradingView.com

Next: GO Markets Expands eFX Network with oneZero Collaboration

Previous: How to Access GO Markets Complimentary VPS