- Home

- News & Analysis

- GO Daily News

- Overnight on Wall Street: Tuesday 08 December 2020

Overnight on Wall Street: Tuesday 08 December 2020

December 8, 2020By Deepta Bolaky

@DeeptaGOMarkets

Equity Markets

Global equities retreated ahead of a busy week ahead with the first round of vaccinations, ECB rate statement, EU summit, Brexit and US stimulus intense negotiations. Investors are concerned and remain cautious amid the rising number of coronavirus cases despite the rolling out of vaccinations in some countries.

Source: Bloomberg Terminal

On the geopolitical front, the tensions between the world’s two most powerful economies kept rising. In his final weeks, President Trump is increasing its pressure on China and issued sanctions on 14 Chinese legislators for national security law on Hong Kong.

On Wall Street, technology stocks rallied pushing the Nasdaq Composite to a new fresh 2020 high while other major indices closed in negative territory:

- The Dow Jones Industrial Average lost 148 points or 0.5% to 30,070.

- S&P 500 fell by 7 points or 0.2% to 3,692.

- Nasdaq Composite rose by 56 points or 0.5% to 12,520.

As coronavirus cases surge and stimulus talks remain murky, investors piled once again in mega-cap technology stocks.

Currency Markets

In the FX space, major currencies remained mixed against the US dollar. Safe-haven currencies like the US dollar, Japanese Yen and Swiss franc firmed to upside in a risk-off environment dragged by geopolitical tensions and virus concerns.

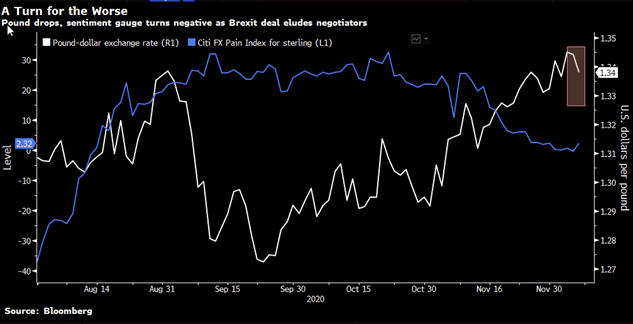

Source: Bloomberg

Brexit drama dominated headlines on Monday after both leaders of Britain and the European Union sent mixed signals to the markets. The GBPUSD pair plunged to a low of 1.3225 during the session but pared losses following a joint statement by European Commission resident Ursula von der Leyen and UK Prime Minister Boris Johnson:

“As agreed on Saturday, we took stock today of the ongoing negotiations, We agreed that the conditions for finalising an agreement are not there due to the remaining significant differences on three critical issues: level playing field, governance and fisheries.

We asked our Chief Negotiators and their teams to prepare an overview of the remaining differences to be discussed in a physical meeting in Brussels in the coming days.”

Monday’s economic calendar was relatively subdued with a few releases:

China

China’s headline Trade Balance for November grew above the $53.5B forecasted to $75.42 billion from $58.44B previous readouts. Exports surged by 21.1% YoY, way above the 12% expected while Imports eased to 4.5% versus 6.1% forecasted. The upbeat data might create more tensions with the US as receding imports from China and increasing exports may fuel new sanctions on Chinese products.

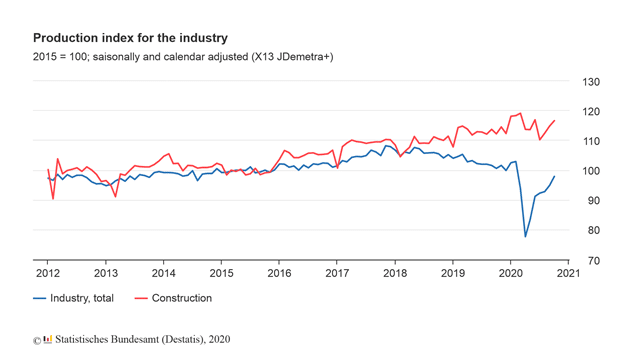

Germany

In October 2020, production in industry was up by 3.2% on the previous month.

Commodities

Crude oil prices lacked direction on Monday but remained in familiar levels on the upside. The oil industry has received a series of good news lately ranging from vaccine updates to OPEC compromise deal.

Last week, in light of the current oil market fundamentals and the outlook for 2021, the OPEC+ agreed to reconfirm the existing commitment from 12 April 2020, then amended in June and September 2020, to gradually return 2 mb/d, given consideration to market conditions. Also, beginning in January 2021, participating countries decided to voluntarily adjust production by 0.5 mb/d from 7.7 mb/d to 7.2 mb/d.

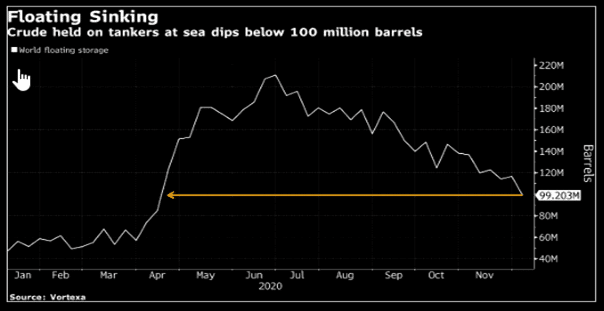

On the supply side, we also note that floating oil inventory on shipments is also reducing. During lockdowns, keeping barrels on tankers were increasingly popular but recent inventories show that crude held at sea has dropped below 100 million barrels.

As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading at around $45.69 and $48.79 respectively. Traders will be eyeing weekly oil reports for fresh trading impetus.

Gold

Gold

The precious metal rose higher on the back of geopolitical tensions between the US and China and surging coronavirus cases. As of writing, the XAUUSD pair was trading around $1,863.

Source: GO MT4

By Deepta Bolaky

Key upcoming events

- Overall Household Spending, Current Account, and Gross Domestic Product (Japan)

- BRC Like-for-Like Retail Sales (UK)

- House Prices Index (Australia)

- Unemployment Rate (Switzerland)

- ZEW Survey – Economic Sentiment and Gross Domestic Product (Eurozone)

- ZEW Survey – Economic Sentiment and Current Situation (Germany)

- Nonfarm Productivity and Unit Labor Costs (US)

| Wednesday, 09 December 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0 | 5.593 | 0.222 | 0.135 | 0.341 | 1.279 | 0.4 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Today in Asia – 08 December 2020

Previous: Overnight on Wall Street: Thursday 03 December 2020