- Home

- News & Analysis

- GO Daily News

- Overnight on Wall Street: Wednesday 11 November 2020

Overnight on Wall Street: Wednesday 11 November 2020

November 11, 2020By Deepta Bolaky

@DeeptaGOMarkets

Equity Markets

The stock market rally fueled by the US elections and vaccines updates tamed down on Tuesday after daily records of coronavirus cases continue to remain high. Global equities ended on a mixed note.

Source: Bloomberg

European stocks extended gains post-Pfizer updates while the US share market was dragged by the tech sell-off.

In the US markets, the Dow finished in positive territory while Nasdaq Composite and S&P 500 dropped in the red dragged by the downbeat performance of the tech giants and shift from growth stocks to small-cap stocks.

- The Dow Jones Industrial Average added 263 points or 0.9% to 29,421.

- S&P 500 fell by 5 points or 0.1% to 3,546.

- Nasdaq Composite lost 160 points or 1.4% to 11,554.

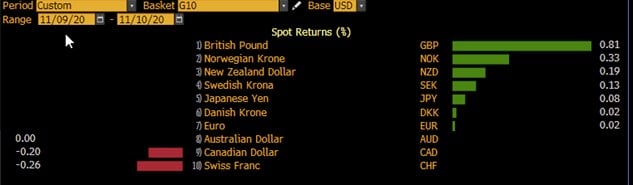

Currency Markets

In the FX space, the price action in the markets was mostly driven by geopolitics and coronavirus updates. Major currencies were mixed against the US dollar.

Source: Bloomberg

The British Pound was among the best-performing currencies against the greenback lifted by positive Brexit headlines and upbeat employment figures:

- Growth in average total pay (including bonuses) among employees for the three months July to September 2020 increased to 1.3%, and growth in regular pay (excluding bonuses) increased to 1.9%.

- Growth in both total pay and regular pay during July to September was higher than inflation.

- UK Oct Claimant Count changed -29.8K vs +36K expected.

- The unemployment rate in the UK rises to 4.8% in September.

The GBPUSD pair rose from the 1.31 level to the 1.32 level.

Source: GO MT4

The EURUSD pair ended relatively flat on Tuesday despite a weaker US dollar dragged by mixed ZEW surveys in Germany and the Eurozone:

- The ZEW Indicator of Economic Sentiment for Germany has once again taken a sharp decline in the current November 2020 survey, plummeting 17.1 points to a new reading of 39.0 points compared to the previous month.

- The financial market experts’ sentiment concerning the economic development of the eurozone also experienced a considerable decrease for the second time in a row. The corresponding indicator now stands at 32.8 points in the November survey, 19.5 points lower than in the previous month.

- The assessment of the economic situation in Germany has slightly worsened, and currently stands at minus 64.3 points, 4.8 points lower than in October.

- By contrast, the indicator for the current economic situation in the eurozone slightly increased by 0.2 points to a new reading of minus 76.4 points.

Source: GO MT4

Commodities

Crude oil prices continue to post gains on the back of the broad optimism in the markets and the positive vaccine news which have hopes of the global oil demand recovery amid lockdown measures. As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading at around $41.88 and $43.61 respectively. Oil traders will now be looking for weekly oil reports for fresh trading impetus.

Gold

Gold

After reaching a daily high of $1,965.52, the precious metal dropped to a low of $1,850 on the vaccines updates and the possibility of only a smaller stimulus package on Monday. The XAUUSD pair recovered some ground yesterday on the back of a weaker US dollar but remained well below the $1,900 mark. As of writing, the XAUUSD pair is trading around $1,877.

Source: GO MT4

By Deepta Bolaky

Key upcoming events

- Fed’s Brainard Speech (US)

- Westpac Consumer Confidence (Australia)

- RBNZ Rate Statement, Interest Rate Decision, Monetary Policy Statement and Press Conference (New Zealand)

- NIESR GDP Estimate (UK)

| Thursday, 12 November 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 3.557 | 8.224 | 0.732 | 0.208 | 0 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 9.897 | 0 | 0 | 0 | 0 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Overnight on Wall Street: Thursday 12 November 2020

Previous: COTD: EURCHF- Emerging Pattern Suggests Reversal