- Home

- News & Analysis

- GO Daily News

- Overnight on Wall Street: Wednesday 25 November 2020

Overnight on Wall Street: Wednesday 25 November 2020

November 24, 2020By Deepta Bolaky

@DeeptaGOMarkets

Equity Markets

Global equities rallied on Tuesday on the broad optimism on the virus front and the political situation in the US. The General Services Administration (GSA) which can ascertain the winner of a Presidential election based on certain criteria and govern under the law for presidential transitions, has recognised Joe Biden as the “apparent winner” and extended around $8 million in transition funding and making other resources available to the Biden transition team.

Investors digested more good news yesterday which eliminated some levels of uncertainties in the markets. In addition to the transition funding, the state of Michigan officially certifies the election results for Joe Biden, fuelling hopes that there is a less chance of a contested election.

Source: Bloomberg

In the US share market, major US equities leapt higher by more than 1% led by a mega-tech rally:

- The Dow Jones Industrial Average added 455 points or 1.5% to 30,046.

- S&P 500 rose by 58 points or 1.6% to 3,635.

- Nasdaq Composite added 156 points or 1.3% to 12,037.

We saw another milestone in the US share market with the blue-chip gauge topping 30,000 for the first time.

Currency Markets

In the FX space, major currencies were stronger against the US dollar. As risk sentiment improves, the greenback lost ground against its peers. Commodity-linked currencies were among the best performing G10 currencies.

Source: Bloomberg

Amid a relatively muted economic calendar, German GDP and IFO data and US housing data stood out:

Germany

- The gross domestic product (GDP) rose by 8.5% in the third quarter of 2020 compared with the second quarter of 2020.. Thus, the German economy could offset a large part of the massive decline in the gross domestic product recorded in the second quarter of 2020 due to the coronavirus pandemic.

- The IFO surveys were mixed. The business climate in the manufacturing sector as compared to the service, trade and construction index improved and companies are also assessing their current situation as markedly better.

The EURUSD found support on the encouraging data and firmed higher.

Source: GO MT4

United States

- Housing Price Index: U.S. house prices rose 7.8% from the third quarter of 2019 to the third quarter of 2020. House prices were up 3.1% in the third quarter of 2020. The monthly index for September was up 1.7 percent from August. Overall, house prices recorded their strongest quarterly gain in the history of the FHFA HPI purchase-only series in the third quarter of 2020.

- S&P CoreLogic Case-Shiller Indices: The 20-City Composite posted a 6.6% year-over-year gain, up from 5.3% in the previous month.

Commodities

The broad optimism in the markets triggered largely by vaccine updates and fuelling hopes that the pandemic may soon be under control is providing support to an-already battered energy market. Crude oil prices continued its rise to the upside on Tuesday. However, WTI pared some gains and eased from the $45 mark following another inventory stockpiles. The American Petroleum Institute reported 3.8 million barrels versus the previous addition of 4.174 million barrels during the week ended on November 20. As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading at around $44.81 and $47.95 respectively. Traders will likely keep monitoring weekly oil reports and OPEC commitments to production cuts for fresh trading impetus.

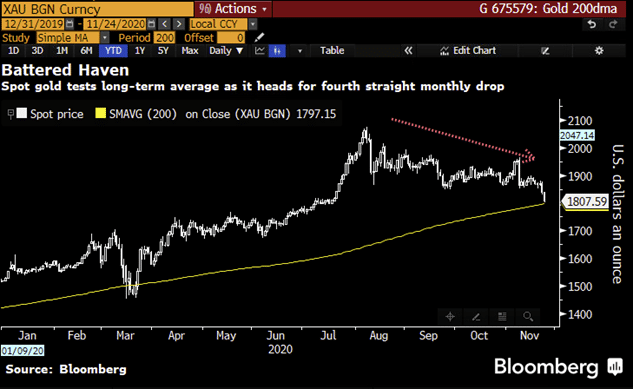

Gold

Gold

The precious metal plunged the most in four months, underpinned by vaccine news and a stronger US dollar. As of writing, the XAUUSD pair was trading around $1,807.

By Deepta Bolaky

Key upcoming events

- RBNZ’s Governor Orr Speech (New Zealand)

- EU Financial Stability Review (Eurozone)

- ZEW Survey – Expectations (Switzerland)

- Durable Goods, Core PCE Expenditures, Personal Income and Spending, Jobless Claims, GDP, Michigan Consumer Sentiment Index, and New Home Sales (US)

- Autumn Forecast Statement (UK)

- Trade Balance, Exports and Imports (New Zealand)

| Thursday, 26 November 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0.148 | 0 | 0 | 0 | 0 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 5.457 | 0 | 0 | 0 | 0 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: COTD: XRPUSD- Increased Demand Could Target $1.18

Previous: Overnight on Wall Street: Tuesday 24 November 2020